Every year, Americans fill over 4 billion prescriptions for generic drugs. These pills cost a fraction of brand-name medicines, saving the U.S. healthcare system billions. But behind every low-cost generic pill is a complex, heavily funded system that keeps it moving from lab to pharmacy shelf. At the heart of this system is the Generic Drug User Fee Amendments - or GDUFA - a program that lets the FDA collect fees from drugmakers to pay for faster, more reliable reviews of generic medications.

Why Generic Drug Reviews Need Funding

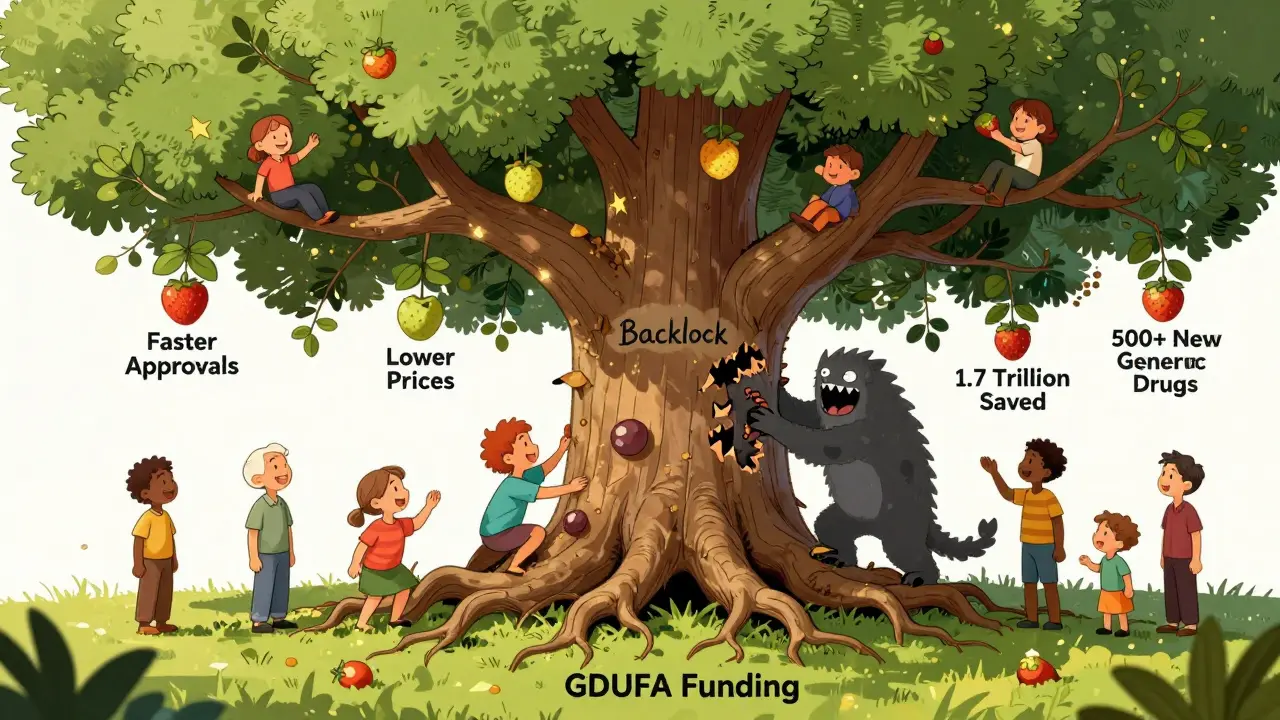

Before GDUFA, waiting for FDA approval of a generic drug could take two to three years. Companies would submit applications, then sit in limbo while the FDA struggled with outdated systems, understaffed teams, and no dedicated budget. The agency relied almost entirely on congressional funding, which never kept up with demand. By 2010, over 1,000 generic applications were sitting untouched, delaying life-saving drugs from reaching patients. GDUFA changed that. Instead of asking Congress for more money, the FDA started charging generic drugmakers a fee for each application they submit. This wasn’t a tax - it was a direct investment. Companies pay to get their drugs reviewed faster, and in return, the FDA commits to clear timelines and better communication. It’s a simple trade: pay a fee, get predictable results.How GDUFA Works: The Four Fees

GDUFA doesn’t just charge one fee. It’s built on four distinct types, each targeting a different part of the drug development process:- Application fee: $124,680 per Abbreviated New Drug Application (ANDA) submitted in FY 2023. This covers the full review of the drug’s safety, effectiveness, and manufacturing quality.

- Program fee: $385,400 per year for any company with an approved generic drug on the market. This helps fund ongoing oversight and system maintenance.

- Facility fee: $25,850 per manufacturing site that produces active ingredients or finished pills. Even if a company uses a third-party factory, that factory must pay this fee.

- DMF fee: $25,850 for each Drug Master File (DMF) that contains confidential manufacturing details for active ingredients. This fee is only charged when the DMF is first referenced in an application.

These fees aren’t random. They’re tied to the actual cost of reviewing each part of the process. The FDA uses the money to hire more reviewers, upgrade computer systems, and conduct inspections - all things that used to be delayed or skipped because of budget cuts.

How GDUFA Compares to Brand-Name Drug Fees

It’s easy to assume that generic drug reviews are easier than brand-name ones. But that’s not true. The science behind proving a generic drug works the same as the brand is just as complex. The difference? The fees.For a new brand-name drug, the FDA charges over $3.4 million per application under PDUFA (Prescription Drug User Fee Act). For a generic version of that same drug? Just $124,680. That’s less than 4% of the cost. Yet the FDA reviews over 1,100 generic applications each year - compared to fewer than 70 new brand-name drugs.

That’s why GDUFA is so critical. Without it, the FDA couldn’t possibly handle the volume. Even with the lower fees, the program funds 75% of the Office of Generic Drugs’ budget. The rest comes from Congress. But without those user fees, review times would creep back to the 30-month average of the pre-GDUFA era.

What GDUFA Has Achieved

Since GDUFA started in 2012, the results have been clear:- Median approval time for generic drugs dropped from 36 months to under 12 months.

- 97% of first-round review goals were met in 2021 - meaning most companies got clear feedback on what needed fixing.

- Generic drug approvals increased by 22% annually after GDUFA launched.

- Over $1.7 trillion in healthcare savings have been generated over the past decade thanks to faster generic entry.

One major win? Transparency. Before GDUFA, companies often got vague rejection letters - “insufficient data” or “not approved.” Now, the FDA provides detailed deficiency letters. Teva Pharmaceuticals’ regulatory team reported that 90% of feedback is now actionable, not just a dead end.

Where GDUFA Still Falls Short

Despite its success, GDUFA isn’t perfect. The biggest complaint? The backlog. Even today, about 1,500 generic applications from before 2012 are still pending. The FDA has pledged to clear them all by September 2024, but delays from the pandemic and increased application complexity have slowed progress.Another issue? The facility fee. Small manufacturers often run just one plant. For them, a $25,850 fee can eat up 15% of their entire regulatory budget. Larger companies with multiple factories spread the cost. In 2022, the Generic Pharmaceutical Association pointed out that this structure unfairly burdens small firms - even though they make up nearly half of all generic drugmakers.

And there’s a gap no one talks about: over-the-counter (OTC) drugs. GDUFA doesn’t cover them. That means common medicines like antacids, cough syrups, and allergy pills - a $117 billion market - still rely on outdated, slow regulatory pathways. Experts are pushing to expand GDUFA to include OTCs, which could generate $150-200 million more in fees and speed up access to safer, more effective products.

Who Qualifies for Fee Discounts?

The FDA offers a 75% fee reduction for small businesses that meet strict criteria: fewer than 500 employees, no more than three approved generic drugs, and no affiliation with larger companies. Sounds fair, right?But here’s the catch: only 18 small businesses applied for this discount in FY 2022. Why? Most don’t know it exists. The application process is confusing. And many fear that applying might flag them as “small” and make them targets for more scrutiny. The FDA has tried to fix this with webinars and help desks, but awareness remains low.

How Companies Pay and Stay Compliant

Paying GDUFA fees isn’t just about writing a check. It’s about navigating a web of rules:- Program fees are due every April 1.

- Facility fees are due October 1.

- Application and DMF fees are paid at submission.

Companies must use the FDA’s electronic system (EUF) to submit payments. If two companies are owned by the same parent, they’re considered “affiliated” - and that changes how fees are calculated. The FDA gets 147 requests each year from companies disputing their fee assessments, often because of unclear ownership rules.

It takes most new regulatory staff 3 to 6 months to fully understand the system. That’s why many small firms hire outside consultants - adding even more cost to an already expensive process.

The Bigger Picture: Why This Matters to Patients

Generic drugs make up 90% of all prescriptions filled in the U.S. But they account for only 23% of total drug spending. That’s because GDUFA keeps the pipeline flowing. When a brand-name drug’s patent expires, GDUFA ensures generics enter the market quickly - often within months, not years.That competition drives prices down. In markets where only one or two companies make a generic drug, prices stay high. But when five or six companies enter, prices can drop by 80% or more. GDUFA’s goal is to prevent monopolies by making it easier for new players to get approved.

The FTC says GDUFA has helped increase timely generic entries by 15% after patents expire. That’s not just good for the economy - it’s life-changing for patients who need daily medications like blood pressure pills, insulin, or antidepressants.

What’s Next for GDUFA?

GDUFA III runs through 2027. But negotiations for GDUFA IV are already underway. The FDA is exploring new ideas:- Using real-world data from electronic health records to support approval decisions - potentially cutting review time even further.

- Expanding coverage to OTC monograph drugs.

- Introducing tiered fees based on drug complexity, not just company size.

Industry feedback is mixed. Some manufacturers welcome innovation. Others worry about new costs. But one thing is clear: GDUFA has proven it works. The Congressional Budget Office estimates that for every dollar the FDA spends on generic reviews, $1.20 comes back in user fees - making it one of the most efficient federal programs in health policy.

The system isn’t flawless. But without GDUFA, millions of Americans would wait longer for affordable medicines. And in a country where one in four people skip prescriptions because of cost, that’s not an option.

What are generic drug user fees?

Generic drug user fees are payments made by manufacturers to the FDA under the Generic Drug User Fee Amendments (GDUFA). These fees fund the review of generic drug applications, inspections of manufacturing facilities, and improvements to the approval system. They are not taxes - they’re fees tied to services provided by the FDA.

How much does it cost to get a generic drug approved by the FDA?

The total cost depends on several factors. The main fee is $124,680 for each Abbreviated New Drug Application (ANDA) submitted. Additional fees include $385,400 annually for having approved drugs on the market, $25,850 per manufacturing facility, and $25,850 for each active ingredient file (DMF) referenced. Small businesses may qualify for a 75% discount on most fees.

Why are generic drug approval fees so much lower than brand-name drug fees?

Brand-name drugs require full clinical trials to prove safety and effectiveness, which is expensive and time-consuming. Generic drugs only need to prove they’re bioequivalent to the brand-name version - meaning they work the same way in the body. The review process is shorter and less resource-intensive, so the fees are lower. Still, the FDA reviews over 1,000 generic applications each year, so volume makes GDUFA a major funding source.

Do GDUFA fees affect the price of generic drugs for consumers?

No - the fees are paid by manufacturers, not patients. The FDA uses the money to speed up approvals and improve oversight, which increases competition among generic makers. More competition drives prices down. Studies show GDUFA has saved consumers over $1.7 trillion since 2012 by getting generics to market faster.

Can small generic drug companies afford GDUFA fees?

It’s difficult. The facility fee alone can cost a small company 15% of its annual regulatory budget. While the FDA offers a 75% fee reduction for qualifying small businesses, only 18 companies used this benefit in 2022. Many don’t know how to apply, or fear the process will expose them to extra scrutiny. As a result, some small firms delay expansions or exit the market.

What happens if a company doesn’t pay its GDUFA fees?

The FDA will not review any applications until fees are paid in full. For ongoing program and facility fees, failure to pay can lead to the withdrawal of approvals for generic drugs already on the market. The agency has no tolerance for nonpayment - it’s a condition of doing business in the U.S. generic drug market.

Is GDUFA only for prescription drugs?

Currently, yes. GDUFA covers prescription generic drugs only. Over-the-counter (OTC) drugs - like pain relievers, antacids, and allergy meds - are regulated under a different, outdated system. Experts are pushing to expand GDUFA to include OTCs, which could improve safety and speed up innovation in that $117 billion market.

I love how GDUFA quietly saves lives every single day. $4 insulin? Thank you. That $124k fee? Worth every penny. The FDA isn’t just a bureaucracy-they’re the unsung heroes keeping our medicine pipeline from collapsing. We need more programs like this, not less.