When a new drug hits the market, you might assume it’s protected by a patent. But that’s only part of the story. In the U.S., many brand-name drugs enjoy regulatory exclusivity-a government-granted shield that blocks generics from even applying for approval for years, regardless of whether the patent is still active. This isn’t a loophole. It’s law. And it’s one of the biggest reasons why some drugs stay expensive for over a decade.

What Exactly Is Regulatory Exclusivity?

Regulatory exclusivity is a time-limited period during which the FDA cannot approve generic or biosimilar versions of a drug. Unlike patents, which protect specific chemical structures or methods of use, exclusivity protects the drug itself. It doesn’t matter if a competitor invents a slightly different version-if it’s meant to treat the same condition, they can’t get approved until the exclusivity clock runs out.

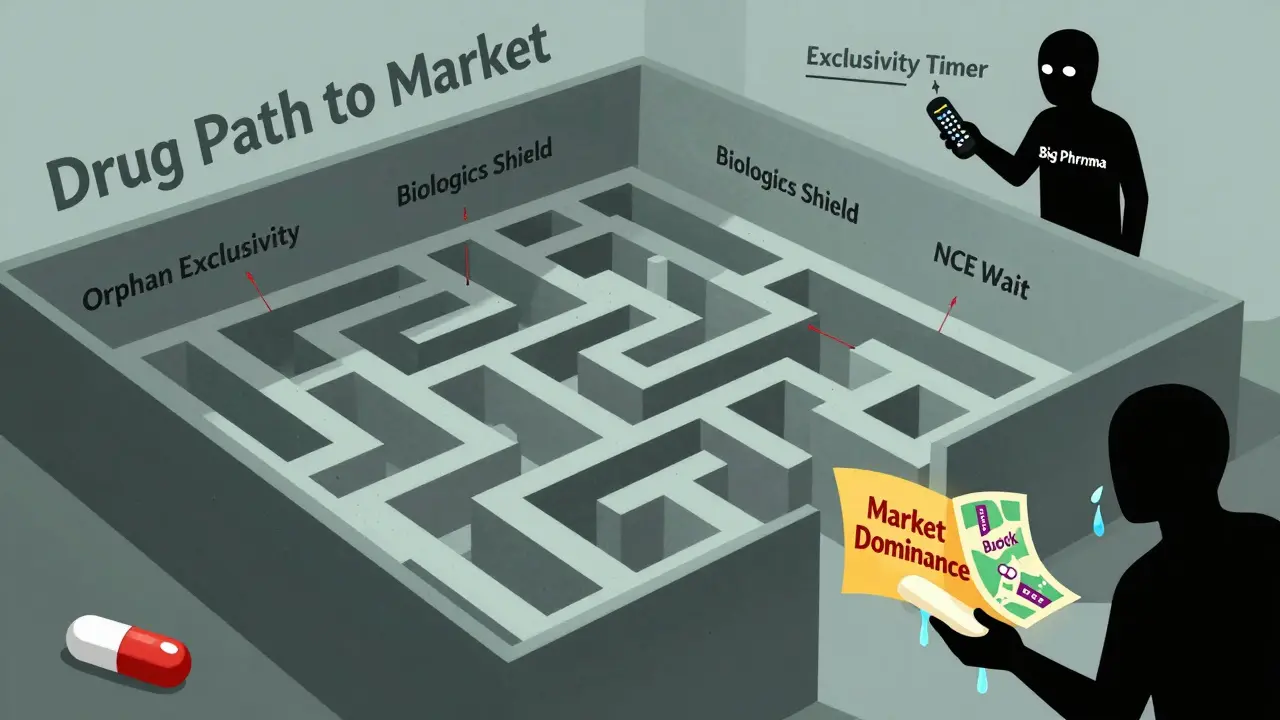

This system was created by Congress in the 1980s to balance two goals: encouraging innovation and allowing competition. The Hatch-Waxman Act of 1984 gave innovators a five-year exclusivity window for new chemical entities (NCEs), while also creating a faster, cheaper path for generics to enter the market later. It was meant to be a fair trade. But over time, the exclusivity periods have grown longer-and so have the prices.

Types of Exclusivity and How Long They Last

Not all exclusivity is the same. The FDA grants several types, each with different rules:

- New Chemical Entity (NCE) Exclusivity: 5 years. During the first 4 years, the FDA won’t even accept an application from a generic maker. At year 5, they can approve it-unless another exclusivity applies.

- Orphan Drug Exclusivity: 7 years. For drugs treating rare diseases affecting fewer than 200,000 people in the U.S. This one is especially powerful because it applies even if the drug isn’t patented.

- Biologics Exclusivity: 12 years. Created by the BPCIA in 2009, this protects complex protein-based drugs like Humira or Enbrel. No biosimilar can be approved until 12 years after the original drug’s approval.

- 3-Year Exclusivity: For new clinical studies that lead to changes in a drug’s labeling-like adding a new use for an existing medicine.

These periods can stack. A drug might have both NCE and orphan exclusivity. Or a biologic might have 12 years of exclusivity on top of patents that expired years earlier. That’s how Humira stayed the only option in the U.S. until 2023-even though its main patent expired in 2016.

How It Works: The FDA’s Role

The FDA doesn’t decide exclusivity based on how good the drug is. It’s automatic. If a company submits the right paperwork and meets the legal criteria, the exclusivity kicks in on approval day. No court battles. No lawsuits. Just a hard stop on generic applications.

That’s why pharmaceutical companies invest so heavily in regulatory strategy. Teams of lawyers and scientists spend months preparing applications to qualify for the longest possible exclusivity. For orphan drugs, they must prove the disease is rare. For biologics, they must show the product is complex enough to qualify under the BPCIA. Even small mistakes can cost years of protection.

The FDA’s Purple Book tracks which drugs have exclusivity and when it expires. But it’s not always easy to read. Many drugs have overlapping protections, and the math gets messy fast. That’s why big pharma hires specialists just to track these dates.

Exclusivity vs. Patents: The Key Differences

People often confuse exclusivity with patents. Here’s how they’re different:

| Feature | Regulatory Exclusivity | Patent Protection |

|---|---|---|

| Granted by | Food and Drug Administration (FDA) | U.S. Patent and Trademark Office (USPTO) |

| Starts when | Drug is approved | Patent is issued (often years before approval) |

| Duration | 5, 7, 12, or 3 years depending on type | 20 years from filing date |

| Enforced by | FDA blocks approval | Patent holder sues infringers |

| Scope | Applies to the drug product itself | Applies to specific claims in the patent |

| Can be challenged? | No-only if the FDA made a mistake | Yes, through court litigation |

Because patents start ticking from the filing date-not approval-many drugs lose patent protection before they even reach the market. A drug can take 8 to 10 years to get approved. That means a 20-year patent might only have 10 years left when the drug is sold. Regulatory exclusivity fixes that. It gives innovators a guaranteed window of market control, no matter how long development took.

Why It Matters for Drug Prices

Exclusivity directly affects what you pay at the pharmacy. IQVIA found that drugs under exclusivity sell for 3.2 times more than their generic equivalents. For biologics, the gap is even wider-sometimes over 10 times more expensive.

Take Humira. AbbVie earned nearly $20 billion in U.S. sales in 2022, even though its core patent had expired six years earlier. That money came from 12 years of exclusivity blocking biosimilars. When they finally arrived in 2023, prices dropped by 60% within months.

But it’s not just big drugs. Orphan drugs-designed for tiny patient groups-often cost over $500,000 a year. With 7 years of exclusivity and no competition, manufacturers have little incentive to lower prices. The FDA approved 47% of new drugs in 2023 as orphan drugs, up from just 18% in 2010. That’s not just innovation-it’s a business strategy.

Global Differences: The U.S. vs. Europe vs. Japan

The U.S. isn’t the only player. Other countries handle exclusivity differently:

- European Union: Uses an "8+2+1" system. Eight years of data protection, then two years of market exclusivity, plus one extra year for new uses.

- Japan: Grants 10 years of data exclusivity for new chemical entities.

- Canada and Australia: Offer 8 years of data protection but no market exclusivity.

The EU is currently pushing to shorten data exclusivity from 8 to 6 years to speed up generic entry. The U.S. has no such plans. In fact, the 12-year biologics exclusivity term is under fire. Bills like H.R. 3013 tried to cut it to 10 years, but pharmaceutical lobbying blocked them.

Who Benefits-and Who Pays?

According to the FDA, 88% of new drugs approved between 2018 and 2023 qualified for at least one form of exclusivity. That’s not coincidence. It’s the norm.

Originator companies love it. A 2024 survey by the Association for Accessible Medicines found 89% of brand-name firms call exclusivity "essential" for recouping R&D costs. Generic manufacturers? Only 42% are satisfied. They say the 4-year waiting period for NCEs forces them to start development without knowing if the drug will even get approved. That’s expensive and risky.

Patients and insurers pay the price. In 2024, originator drugs made up 68% of the global pharmaceutical market-$965 billion out of $1.42 trillion. That’s mostly because exclusivity keeps competition out.

The Future: Will Exclusivity Change?

Pressure is building. Governments are struggling with rising drug costs. The FDA’s 2024-2026 Drug Competition Action Plan says it wants to "modernize exclusivity frameworks" to better balance innovation and access.

Experts predict the average combined patent and exclusivity period will drop from 12.3 years to 10.8 years by 2030. But biologics? They’re likely to keep their 12-year shield. The science is too complex. Replicating them isn’t like copying a pill.

Still, the trend is clear: exclusivity isn’t going away-but its length might. The real question is whether it will shrink enough to make a difference for patients-or just enough to look like reform without changing much.

How to Know If a Drug Has Exclusivity

If you’re wondering why a drug has no generic, check the FDA’s Purple Book. It’s free, updated weekly, and lists every drug with active exclusivity and its expiration date.

For patients: Ask your pharmacist. If a drug has no generic, it might not be because of patents-it might be because of exclusivity. And that means you’re stuck paying brand prices for years to come.

Final Thoughts

Regulatory exclusivity isn’t a secret. It’s written into U.S. law. But most people don’t know it exists. And that’s the problem. When a drug stays expensive for 10, 12, even 15 years, it’s not because of patents. It’s because of this hidden system. It’s not broken. It’s working exactly as designed-for drugmakers. Whether it’s working for patients is another question entirely.

Is regulatory exclusivity the same as a patent?

No. Patents protect inventions and are granted by the patent office. Exclusivity is granted by the FDA and blocks generic approval regardless of patent status. Exclusivity starts at drug approval; patents start at filing-often years earlier.

Can a drug have both patent and exclusivity protection?

Yes. Most new drugs have both. Exclusivity often lasts longer than the remaining patent term. For example, a biologic might lose its patent in year 8 but still be protected by 12 years of exclusivity.

Why do some drugs have no generic for over 10 years?

Because of regulatory exclusivity. Even if the patent expired, the FDA can’t approve a generic until exclusivity ends. Biologics get 12 years, orphan drugs get 7, and new chemical entities get 5. That’s why Humira had no biosimilars until 2023, even though its patent expired in 2016.

Does exclusivity apply outside the U.S.?

Yes, but differently. The EU uses an 8+2+1 system. Japan gives 10 years of data exclusivity. Canada and Australia offer data protection but no market exclusivity. The U.S. has some of the longest exclusivity periods globally.

Can exclusivity be extended?

Not directly. Unlike patents, exclusivity can’t be extended through legal loopholes. But companies can file for multiple types of exclusivity on the same drug-like combining orphan and NCE exclusivity-to stretch protection. This is legal and common.

What’s the difference between data exclusivity and market exclusivity?

Data exclusivity means generics can’t use the originator’s clinical trial data to get approval. Market exclusivity means generics can’t sell their version-even if they develop their own data. The U.S. has both. The EU separates them: 8 years data, then 2 years market.

Wow, I never realized exclusivity could stack like that. I thought patents were the main barrier, but seeing how Humira stayed protected for 7 extra years after patent expiry? That’s wild. FDA’s Purple Book should be mandatory reading for anyone on chronic meds.